Are you looking for a credit report example? In this article you will find just what you’re looking for. If the idea of deciphering your credit report has ever seemed like navigating a maze of financial jargon, fear not! Our goal is to simplify the process, by providing a credit report example that will allow you to understand the information contained within.

By the end of this article, you’ll be equipped with the knowledge to not only read your credit report but also to use it to your advantage. So, let’s embark on a journey through a credit report example, unraveling it section by section.

This post contains affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

What Is A Credit Report?

A credit report is a document that summarizes your credit history and provides a snapshot of how you’ve managed credit over time.

This report typically includes information about your credit accounts, along with details on how diligently you’ve paid your bills. It also shows if you’ve had any late payments or if you’ve ever defaulted on a loan.

What Is A Credit Report Used For?

A credit report is primarily used by lenders, such as banks and credit card companies, to evaluate your financial history. It showcases your borrowing and repayment habits.

A good credit report signals to lenders that you’re a responsible borrower, increasing your chances of being approved for loans and getting favorable interest rates.

On the flip side, a not-so-great credit report might make lenders hesitant to extend credit or result in higher interest rates.

It’s not just lenders who take a peek, though. Landlords, employers, and even insurance companies may also use your credit report to make decisions about renting to you, hiring you, or setting your insurance premiums.

So, whether you’re aiming to buy a home, snag a new job, or secure a credit card with perks, understanding and maintaining a positive credit report is a key financial move. Keep those payments timely, and your credit report will be your financial ally.

Sections Of A Credit Report

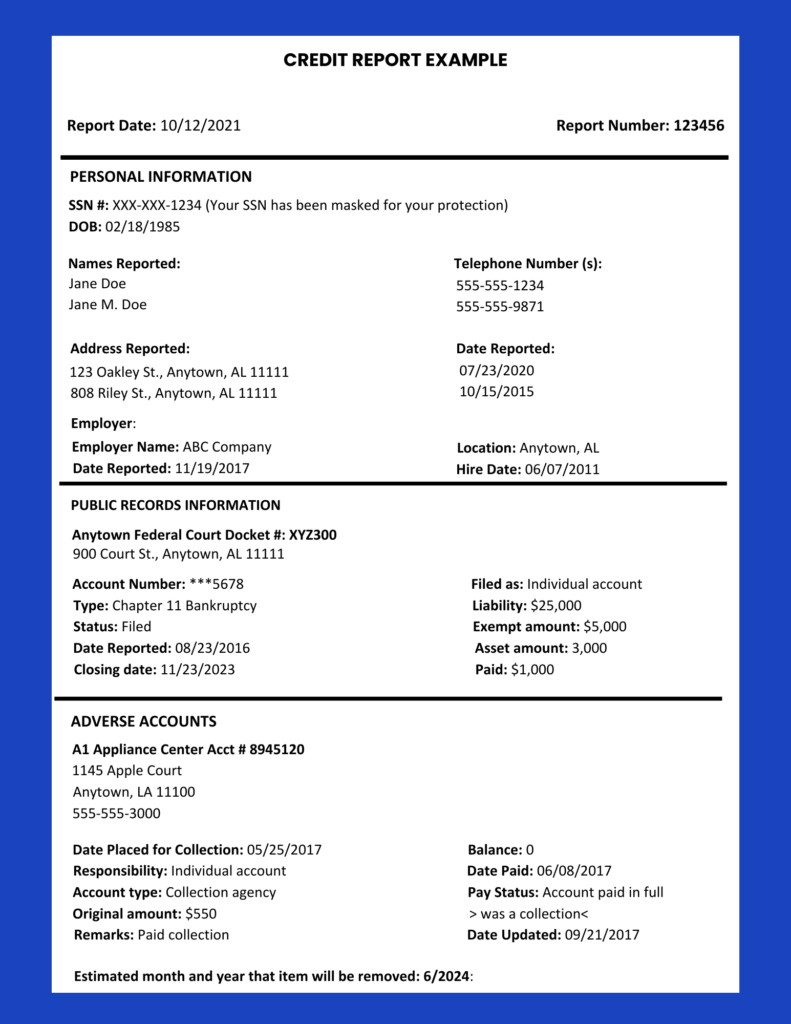

Your credit report holds important details about you, such as personal information, credit account history, credit inquiries, and public records. Lenders and creditors report this information to credit bureaus, which, in turn, use it to calculate your FICO® Scores.

The Three major credit bureaus—Experian, Equifax, and TransUnion—compile and format your information. Despite some differences in presentation, all credit reports share the same fundamental categories of information.

These categories include personal information, public records, credit accounts, and credit inquiries.

So, let’s break down these categories to help you better understand your credit report:

Personal information:

The personal information section is used to identify who you are. This information is normally furnished by you to creditors or lenders when you apply for credit. You may find the following types of information on all of your credit reports, regardless of the bureau.

• Name

• Address

• Phone Number

• Social security number

• Date of birth

• Employer

Public records:

The public records section of a credit report refers to entries that are recorded by a court at the local, county, state, or federal level. This section can also include unpaid child support.

• Bankruptcies

• Foreclosures

• Civil suits

• Court judgments

• Tax liens

• Overdue child support

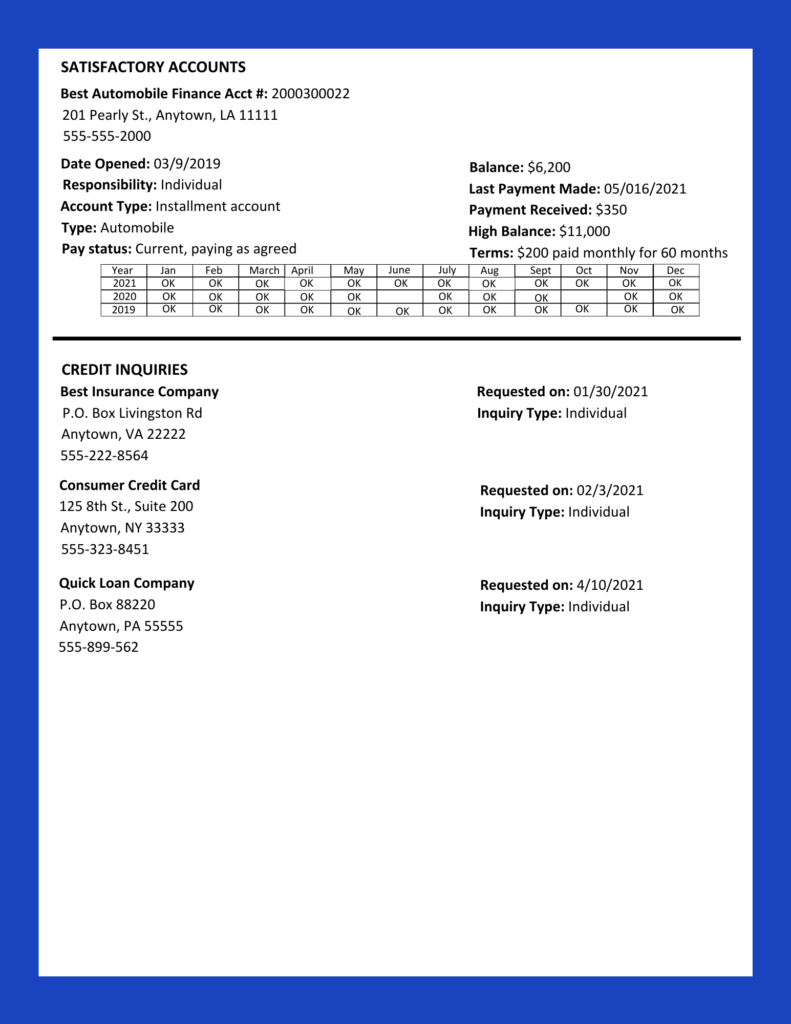

Credit accounts:

This section is the meat of your credit report. You will find information about your borrowing and repayment history.

This can include a list of current and previous accounts such as credit cards, mortgages, car loans, and student loans. Each account listed may include the following details:

• Name of the creditors or lenders

• Opening date and/or closing date of the account

• Credit limit or loan amount

• Account balance

• Payment history

Inquiries:

The inquiries section contains a list of everyone who accessed your credit report within the last two years. Credit inquiries fall into two categories: soft and hard inquiries.

Soft inquiries:

May result from checking your own credit reports, companies extending you pre-approved offers of credit or insurance, or your current creditors conducting periodic account reviews. Soft inquiries does not affect your credit score.

Hard inquiries:

Recorded whenever you apply for a line of credit, whether it’s a credit card, car loan, mortgage, or another type of credit. Lenders will “pull” your credit report to check your credit information and see whether you qualify for a loan.

Each time this happens, a record of the hard inquiry goes on your credit report and affects your credit score

Credit Report Example

What Can Hurt Your Credit Report?

One common pitfall is late payments on credit accounts. Timely payments are the backbone of a positive credit history, and even a single late payment can leave a lasting mark.

Another factor to be wary of is the excessive use of credit, as carrying high balances relative to your credit limit can negatively affect your credit score.

Additionally, the length of your credit history matters, so closing old credit accounts might seem like a good idea, but it can actually shorten your credit history and potentially lower your score.

Be cautious with new credit applications too, as each application results in a hard inquiry on your credit report, which can have a temporary impact.

Lastly, defaulting on loans or declaring bankruptcy can significantly damage your creditworthiness.

What To Do If There Is An Error On Your Credit Report

If you discover an error on your credit report, don’t panic – you’re not alone, and there are steps you can take to set things right.

First things first, obtain a copy of your credit report from each of the major credit bureaus – Equifax, Experian, and TransUnion. Review the reports carefully, keeping an eye out for inaccuracies such as incorrect account information, late payments, or unfamiliar accounts.

If you spot an error, gather supporting documentation that verifies the correct information. Next, initiate a dispute with the credit bureau in question by submitting a dispute letter along with the documentation.

Be patient, as the investigation process may take some time. While waiting, it’s essential to continue monitoring your credit and keeping records of your correspondence.

Once the investigation is complete, review the updated credit report to ensure the corrections have been made.

Finally, notify your creditors of the resolution to ensure they have the accurate information moving forward.

Remember, addressing credit report errors requires diligence, but the potential benefits for your financial well-being make it a worthwhile endeavor.